China’s internet user base reached 1.123 billion by June 2025, adding 14.36 million in six months, for a penetration rate of 79.7%

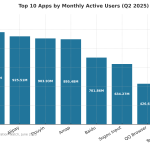

Mobile internet monthly active users (MAUs) climbed to 1.267 billion, up 2.5% year-on-year, with daily average usage hitting 7.97 hours and 117.9 sessions

Rural internet penetration rose to 69.2%, narrowing the urban–rural gap, as smaller cities and counties became new growth engines

Short video platforms reached 1.068 billion users, while micro-drama audiences grew to 626 million, reshaping content monetization

E-commerce MAUs surged during the 618 festival, with JD.com’s daily actives up 33.2% and Meituan’s up 18.2% in June

Over the past 18 months, China’s digital landscape has transitioned from breakneck user acquisition to competing for depth of engagement. National broadband and 5G coverage targets have been met, with over 90% of administrative villages covered by 5G (CNNIC, June 2025).

At the same time, macroeconomic recovery and targeted consumption stimulus — including subsidies for electronics and vehicles — have bolstered online retail and travel.

QuestMobile data shows that by mid-2025, mobile internet’s monthly active users stood at 1.267 billion, up 2.5% year-on-year. Average daily use grew 7.8% to 7.97 hours, while sessions rose 2.6% to 117.9 per day. This signals that even in a saturated market, users are giving more of their attention — and wallets — to digital channels.

China Internet users and penetration 2025By June 2025, China had 1.123 billion internet users, up 14.36 million from December 2024, representing 79.7% of the population (CNNIC, June 2025). Mobile internet users totaled 1.116 billion, or 99.4% of all netizens.

GIPHY App Key not set. Please check settings