Dangote Refinery has responded to the NNPCL announcement that a $1 billion loan secured to help the refinery through its financial issuesThe refinery explained that the story is inaccurate because $1 billion is only roughly 5% of the total amount of money invested in the refinery’s construction According to a statement, the state oil corporation was then given a 12-month period to pay cash for the remaining shares but failed to meet upLegit.ng journalist Zainab Iwayemi has 5-year-experience covering the Economy, Technology, and Capital Market

Dangote refinery has reacted to report by the Nigerian National Petroleum Company Limited (NNPCL) that a a $1 billion loan backed by its crude was secured to support the refinery during liquidity challenges.

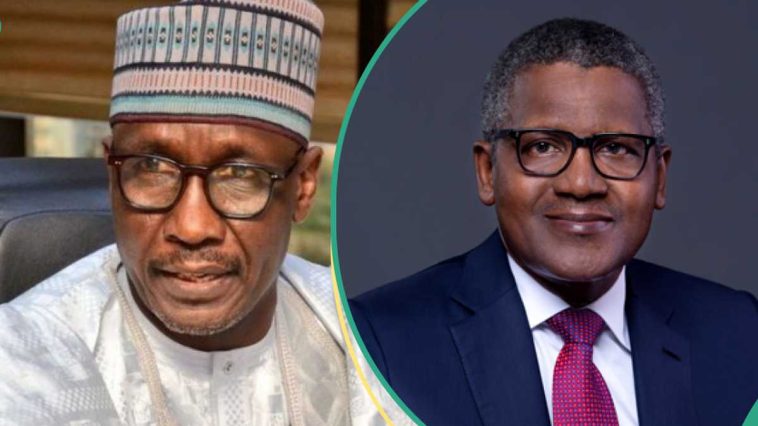

Photo Credit: FG

Source: UGCIn a report signed by Anthony Chiejinak, its Group Chief Branding and Communications Officer, the refinery clarified that the report is a misrepresentation of the situation as $1bn is just about 5% of the investment that went into building the Dangote Refinery.

According to the refinery, its decision to enter into a partnership with NNPCL was based on recognition of their strategic position in the industry as the largest off taker of Nigerian crude and at the time, the sole supplier of gasoline into Nigeria.

“We agreed on the sale of a 20% stake at a value of $2.76 billion. Of this, we agreed that they will only pay $1 billion while the balance will be recovered over a period of 5 years through deductions on crude oil that they supply to us and from dividends due to them. If we were struggling with liquidity challenges, we wouldn’t have given them such generous payment terms. “As at 2021 when the agreement was signed, the refinery was at the pre-commission stage. In addition, if we were struggling with liquidity issue, this agreement would have been cash based rather than credit driven.”“Unfortunately, NNPCL was later unable to supply the agreed 300 thousand barrels a day of crude given that they had committed a greater part of their crude cargoes to financiers with the expectation of higher production which they were unable to achieve.”The statement added that a 12-month period was subsequently given to the state oil company buy pay cash for the balance of their equity given their inability to supply the agreed crude oil volume but NNPCL failed to meet this deadline which expired on June 30th 2024, hence, their equity share was revised down to 7.24%.

Dangote refinery exports PMS to another African countryLegit.ng reported that the Dangote Refinery and Neptune Oil have announced their maiden petrol export to Cameroon, representing a significant step in regional energy integration and collaboration.

The firms described the shipment as a strategic collaboration to strengthen economic ties between the two countries while addressing rising energy demands in the region.

The two firms are exploring further plans to establish a reliable supply chain, stabilise fuel prices, and create new economic opportunities in the region.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng

GIPHY App Key not set. Please check settings